All Categories

Featured

Table of Contents

Passion will certainly be paid from the date of death to date of payment. If death is due to all-natural reasons, death proceeds will certainly be the return of premium, and passion on the premium paid will certainly be at a yearly efficient price defined in the plan agreement. Disclosures This plan does not ensure that its profits will certainly be enough to spend for any particular service or goods at the time of requirement or that services or merchandise will be offered by any kind of particular supplier.

A complete statement of protection is found only in the plan. Rewards are a return of costs and are based on the actual mortality, expenditure, and investment experience of the Firm.

Permanent life insurance creates cash money worth that can be borrowed. Plan financings accumulate rate of interest and unpaid plan financings and interest will certainly reduce the survivor benefit and cash money value of the policy. The amount of money worth available will typically depend upon the kind of irreversible plan purchased, the amount of coverage bought, the length of time the policy has actually been in pressure and any exceptional policy car loans.

Associate web links for the items on this page are from partners that compensate us (see our advertiser disclosure with our checklist of partners for even more information). Nonetheless, our opinions are our very own. See just how we rate life insurance policy items to write unbiased item testimonials. Funeral insurance policy is a life insurance policy that covers end-of-life expenses.

Interment insurance policy requires no clinical test, making it obtainable to those with medical conditions. This is where having burial insurance policy, additionally recognized as last expenditure insurance, comes in useful.

However, streamlined concern life insurance coverage calls for a health assessment. If your wellness status invalidates you from traditional life insurance policy, funeral insurance may be an option. In addition to less health and wellness exam requirements, funeral insurance has a fast turnaround time for authorizations. You can obtain insurance coverage within days or also the exact same day you apply.

Buy Burial Insurance

, funeral insurance coverage comes in numerous types. This plan is best for those with mild to modest health problems, like high blood pressure, diabetic issues, or asthma. If you do not desire a medical exam but can certify for a simplified problem policy, it is generally a far better deal than an ensured issue policy due to the fact that you can obtain even more coverage for a more affordable costs.

Pre-need insurance policy is high-risk since the recipient is the funeral home and coverage is certain to the picked funeral home. Ought to the funeral chapel go out of service or you move out of state, you might not have insurance coverage, which defeats the function of pre-planning. Furthermore, according to the AARP, the Funeral Consumers Partnership (FCA) recommends against getting pre-need.

Those are basically funeral insurance policies. For ensured life insurance policy, costs estimations depend on your age, gender, where you live, and protection amount. Understand that coverage amounts are limited and vary by insurance policy supplier. We located sample quotes for a 51-year-woman for $25,000 in insurance coverage living in Illinois: You may choose to pull out of burial insurance if you can or have actually saved up enough funds to pay off your funeral service and any kind of arrearage.

Over 50 Funeral Insurance

Funeral insurance coverage supplies a streamlined application for end-of-life coverage. A lot of insurance coverage firms need you to talk to an insurance agent to use for a policy and acquire a quote.

The goal of living insurance policy is to alleviate the worry on your liked ones after your loss. If you have a supplementary funeral service plan, your enjoyed ones can use the funeral plan to handle final costs and get an immediate dispensation from your life insurance policy to deal with the home mortgage and education and learning expenses.

Individuals who are middle-aged or older with clinical conditions might consider funeral insurance coverage, as they might not get approved for standard policies with stricter approval requirements. Additionally, funeral insurance can be useful to those without comprehensive cost savings or conventional life insurance policy coverage. life insurance to cover burial costs. Burial insurance coverage differs from various other sorts of insurance coverage in that it offers a reduced survivor benefit, usually just adequate to cover costs for a funeral and other connected expenses

ExperienceAlani is a former insurance coverage fellow on the Personal Finance Insider team. She's evaluated life insurance policy and family pet insurance coverage companies and has actually created countless explainers on traveling insurance, credit, financial obligation, and home insurance policy.

Best Funeral Insurance Policy

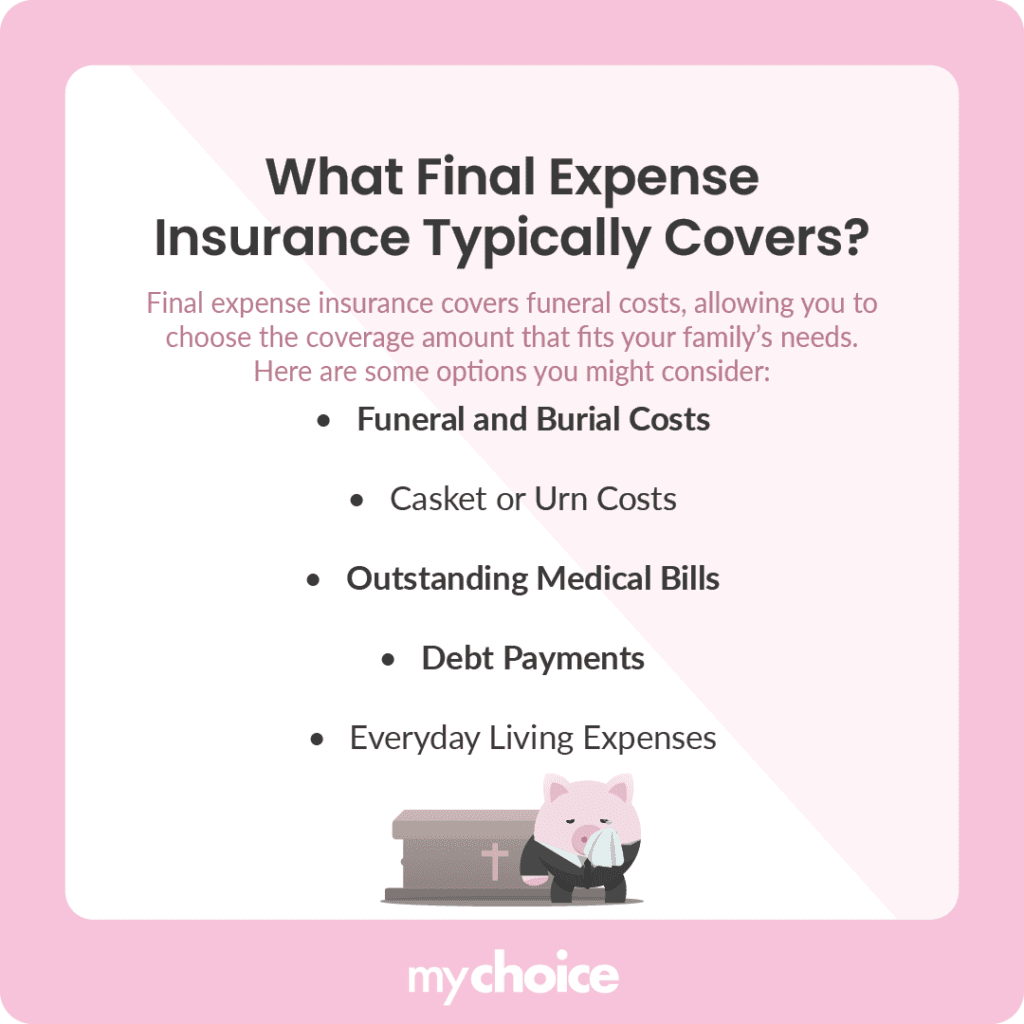

Final expenditure life insurance coverage has a number of advantages. Final cost insurance is frequently suggested for seniors who might not certify for standard life insurance due to their age.

In addition, final expenditure insurance is valuable for people who desire to spend for their own funeral. Funeral and cremation services can be expensive, so final expense insurance offers satisfaction knowing that your loved ones won't need to utilize their cost savings to pay for your end-of-life plans. Final cost coverage is not the ideal item for everyone.

Getting whole life insurance policy via Ethos is quick and easy. Protection is readily available for elders between the ages of 66-85, and there's no clinical examination needed.

Based on your actions, you'll see your approximated price and the quantity of coverage you receive (between $1,000-$ 30,000). You can purchase a plan online, and your coverage starts immediately after paying the very first premium. Your price never ever alters, and you are covered for your whole lifetime, if you proceed making the regular monthly repayments.

Paying For A Funeral Without Life Insurance

Final expense insurance coverage uses advantages but requires mindful factor to consider to determine if it's right for you. Life insurance can resolve a range of financial requirements. Life insurance for last costs is a kind of irreversible life insurance policy developed to cover expenses that occur at the end of life - final insurance. These plans are reasonably very easy to get approved for, making them suitable for older people or those who have health and wellness concerns.

According to the National Funeral Service Supervisors Organization, the average cost of a funeral service with funeral and a viewing is $7,848.1 Your enjoyed ones might not have accessibility to that much money after your fatality, which could add to the tension they experience. Additionally, they may experience other expenses connected to your death.

Final expenditure insurance coverage is in some cases called funeral insurance coverage, but the cash can pay for virtually anything your liked ones require. Recipients can use the fatality benefit for anything they require, enabling them to resolve the most important monetary concerns.

: Hire professionals to help with handling the estate and browsing the probate process.: Close out make up any kind of end-of-life therapy or care.: Pay off any various other financial obligations, including car car loans and debt cards.: Recipients have complete discernment to make use of the funds for anything they need. The cash might also be made use of to create a heritage for education and learning costs or given away to charity.

Latest Posts

Funeral Insurance Jobs

Funeral Policies For Over 65

Funeral Cost Insurance